![Unlocking the Potential of AI Technology: A Step-by-Step Guide to Investing [with Real-Life Success Stories and Key Statistics]](https://thecrazythinkers.com/wp-content/uploads/2023/04/tamlier_unsplash_Unlocking-the-Potential-of-AI-Technology-3A-A-Step-by-Step-Guide-to-Investing--5Bwith-Real-Life-Success-Stories-and-Key-Statistics-5D_1682836009.webp)

- AI technologies have already begun replacing human tasks across various industries such as healthcare or logistics, so investing now could be very timely.

- The most significant players within this arena include companies like Alphabet (Google), Amazon, IBM or Nvidia but there’s a vast array of startup companies too which should not be overlooked when considering investment options.

- To successfully invest in this rapidly developing field requires an appropriate level of knowledge concerning developments and innovations

If you want advantages over competitors by positioning yourself for technological change opportunities then learning more about investments involving artificial intelligence might provide avenues worth exploring that may lead towards significant potential reward.

1.What exactly is AI?

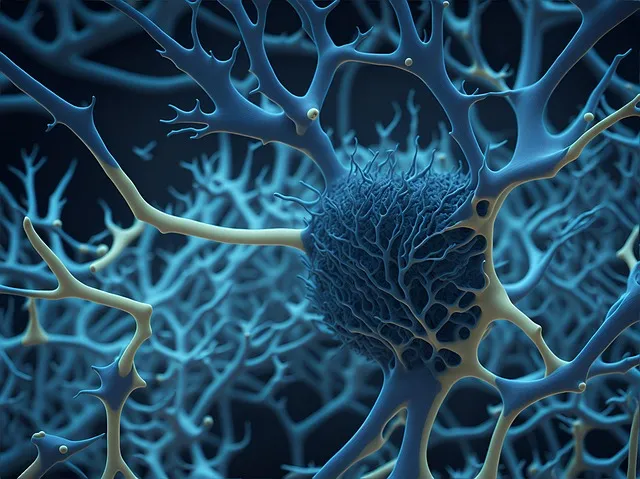

Artificial intelligence involves building systems or machines that can perform tasks that would typically require human beings’ cognitive functions such as problem-solving or decision-making. This includes skills like speech recognition, image recognition & processing natural language generation etc.

2.How does it work?

At its core lies machine learning algorithms fed with data sets which the system learns from while enabling next-process decisions based on what-outcomes had resulted previously

3.What areas benefit most from artificial intelligence?

4.What kind of businesses should I consider or avoid when looking for an investment opportunity related to AI?

It’s good practice doing adequate research before choosing your portfolio since you want stocks whose value will experience significant growth due forced by using intelligent technologies

5.How much money do I need to invest?

Depends on personal agenda While sizeable investments guarantee higher yields returns . Why? The investor’s appetite often reflects- deposit amounts to ensure maximum gains upfront profits

6.Which US companies are leading the charge into implementing/investing heavily into Artificial Intelligence solutions?

Some top USA -based companies include Microsoft,KPMG,PwC,Samsung ,Amazon Google -amongst othrs

1. Understanding The Types Of AI

– Machine Learning: A type of software that learns from data patterns over time.

– Deep Learning: A subset of machine learning focused specifically on neural networks and modeling complex relationships between inputs and outputs.

– Natural Language Processing (NLP): An area focused on helping computers understand human language more accurately.

2. Identifying Potential Business Use Cases For AI

While many companies see great potential upside with adopting artificial intelligence into their operations or marketing efforts immediately; identifying what areas within your operation could benefit most from automation should be done first lest potential returns fall short or become unsustainable after implementation without goals sign posts established prior.

3. Breaking Down Costs & ROI Expectations For Your Ideal Solution

Another critical factor when considering investment in ai technologies is determining costs associated alongside accurate ROI projections based on potential returns which include factors such as efficiency boosts, ROI expectations and executing against potential downside risk with a sound plan in place (i.e. pros/cons analysis).

Investing is not just about finding the right solution for now – it’s also about making sure that your company remains at the forefront of technology developments over time so you are able to achieve continued growth and stay nimble within a changing business environment.

5. Choose The Right Vendor

Identify Your Business Goals

It is essential to understand these goals quickly upfront because without knowing them beforehand makes assessing potential investments’ influence almost impossible like measuring distance with a ruler – without calibrated units.

Determine What Types Of Data Will Be Required For Implementation

Select A Reliable Vendor Or Consultant With Relevant Expert experience And Technical Know-How

Organizations should not venture blindly and dive headfirst into markets they know little about – this maxim applies strongly especially in emerging sectors such as Artificial Intelligence/augmented analytics/machine learning moving beyond Big data and analytics. Therefore, identifying knowledgeable vendors or experienced consultants to assist in the assessment of AI-driven technologies is a crucial step towards making informed investment decisions such that would maximize return on investments.

Evaluate The Technological Sensitivity Of The Investment

AI technology is perpetually evolving – new products are being developed very fast which indicates technological obsolescence risk remains high for those who fail to identify and invest with caution. A significant factor to consider when investing in an AI-powered product would be evaluating compatibility dependencies with existing systems (ie., legacy software) as well as reviewing alternatives tech solutions available concerning pricing, scalability and user experience feedback within related industry sectors.

Be Prepared To Learn And Adapt Quickly

Remaining adaptive whilst ensuring strong communication flows during roll-out periods will aid businesses to anticipate challenges associated with adopting/-the changes brought by deployed AI-powered tools. As suggested earlier, cognitive computing/artificial intelligence solutions evolve quickly(through adaptations or upgrades), thus having strategies in place ensures that stakeholders continually acquire knowledge/skills necessary for adapting emerging methodologies capable of delivering tangible ROI from underlying projects specific objectives over time.

In conclusion, successfully capitalizing on promising artificial intelligence opportunities can provide enormous benefits for companies looking to stay ahead of the competition; but alongside implementing all the steps previously mentioned above, always keep tabs on market trends surrounding target demographics carefully- staying aware/updated about changing customer behavior/preferences could help tailoring suitable recommendations in real-time subjected only possible through machine learning algorithms facilitated via big data analytics ultimately driving advantage competitively!

On the flip side, matured sectors harbor less opportunities but also produce more predictable returns than those at early-stage startups/innovations where one would probably witness spikes taking place depending on trends effecting demand/supply – Making ‘time’ a critically pivotal factor for harvesting maximum benefits

On a related note, while Big-data analytics solutions enterprise Palantir’s public persona may be under heat lately over being labelled ‘creepy’ by reported data-invasion privacy concerns but their Share-prices confirmed hitting new historic highs after another successful Q1 earnings report due to recent deal-signings with British National Health Services/Arab Emirates Govt cyber security firms/pwc-based Global consulting firm Accuitecncies/NASA/Microsoft. This evidence suggest investors should not shy away from considering one or two high-value investments in this sector if they believe in diversification avoiding frequent zig-zags based on market variables – As long as there exists ample strategic value backing those technologies seemingly bringing measurable impact within society-service contexts dominating all spheres representing real-flagship showon the oarage-yacht.

But what does it take to build a diversified portfolio through investing in AI? Here are some key steps you can follow:

Step 1: Understand Your Investment Objectives

Step 3: Find Companies That Cater To Your Unique Risk Profile

After identifying which kind of artificial intelligence suits your needs bests coupled with awareness about market trends determining industry leaders then companies capable enduring the rapidly shifting landscape should be considered based on their prior achievements relating widely accepted metrics set by institutions particular enforcing bodies within sectors whereby they operate .

Step 4: Conduct Thorough Research And Analysis

The final word

To get started efficiently while avoiding unnecessary risks associated with industries growing at such rapid rates coupled extending recognition within various domains: identify narrow or broad-minded specific goals , determine acceptable levels of risk exposure/consequences prior developing proactive pricing strategies accordingly conducting thorough analysis-based scrutiny including standard benchmark assessments before jumping onboard!

Let’s explore some of these options:

2. Venture capital funds: Another option is investing in venture capital firms that focus on AI-related companies. These firms typically invest large sums of money into multiple startups at once, hoping that one or two will become successful and ultimately cover their losses from those that do not pan out as expected.

4. Robotics and automation technologies: The increasing sophistication of robots complemented by advancements in artificial intelligence algorithms explain why robotics presents several investment opportunities outside traditional technological fields such as defense transport warehousing etc.

5.AI Infrastructure stocks- Semiconductor Chips making co’s components which power computers hardware manufacturers who build data centers servers Storage systems cloud provisioning services

Table with useful data:

| Investment Type | Description |

|---|---|

| Venture Capital (VC) Funding | |

| Public Company Stocks | |

| Exchange Traded Funds (ETFs) | |

| Mutual Funds | |

| Angel Investing |

Information from an expert

Historical fact:

It is believed that the first development of artificial intelligence technology can be traced back to the Dartmouth Conference in 1956, where researchers discussed the possibility of creating machines that could learn and solve problems on their own.

![Unlocking the Power of Social Media Technology: A Story of Success [With Data-Backed Tips for Your Business]](https://thecrazythinkers.com/wp-content/uploads/2023/05/tamlier_unsplash_Unlocking-the-Power-of-Social-Media-Technology-3A-A-Story-of-Success--5BWith-Data-Backed-Tips-for-Your-Business-5D_1683142110-768x353.webp)

![Revolutionizing Business in the 1970s: How Technology Transformed the Corporate Landscape [Expert Insights and Stats]](https://thecrazythinkers.com/wp-content/uploads/2023/05/tamlier_unsplash_Revolutionizing-Business-in-the-1970s-3A-How-Technology-Transformed-the-Corporate-Landscape--5BExpert-Insights-and-Stats-5D_1683142112-768x353.webp)

![Discover the Top 10 Most Important Technology Inventions [with Surprising Stories and Practical Solutions]](https://thecrazythinkers.com/wp-content/uploads/2023/05/tamlier_unsplash_Discover-the-Top-10-Most-Important-Technology-Inventions--5Bwith-Surprising-Stories-and-Practical-Solutions-5D_1683142113-768x353.webp)